The Terminator has a lot to answer for. As the prospect of Artificial Intelligence (AI) becomes a reality in the workplace, barely a day goes by without a headline warning of some machine-led threat to jobs and livelihoods. It is indeed likely systems integration based on AI and Robotic Process Automation (RPA), an emerging form of business transformation based on the software robots, will change how we work and live. But not in the doomsday-scenario way often portrayed.

Instead, a technology called process mining could help usher in a new world of opportunity. Before we see how, let’s take another look at the doomsday scenario. Financial services is often cited as one of the industries where workers are most at risk from RPA. In April this year, for example, the analyst group IHS Markit released a study predicting that around 500,000 bank workers in the UK, and 1.3 million in the US, could be affected by RPA by 2030.

“If this is mirrored across all countries globally, then there will be tens of millions of banking and financial services jobs impacted by the introduction of AI technology in the coming decade,”

- the analyst group IHS Markit.

RPA: the full story

It would be naïve to argue against this. RPA and AI are already having an impact on many jobs in the financial services sector, either making people redundant altogether or forcing them into alternative roles. But it turns out that this isn’t even half of the story, according to Professor Gianvito Lanzolla, chair in strategy, head of the Faculty of Management and founding director of the Digital Leadership Research Centre at the Cass Business School, City, University of London.

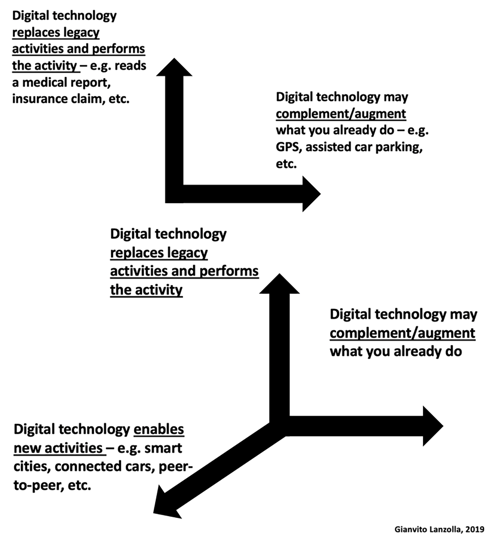

In a recent talk hosted by Infomentum, Professor Lanzolla explained that digital technologies such as AI and RPA are usually seen as triggering one of two types of business model transformation: replacement and augmentation. Replacement involves getting RPA to do legacy activities often carried out by humans. Professor Lanzolla gives the example of reading medical reports, but in financial services there are plenty of similar low-skilled tasks, such as processing invoices or insurance claims, that could be handed over to robots.

The at-risk workloads identified by IHS Markit include those traditionally carried out by tellers, customer service reps, loan interviewers and clerks, financial managers, compliance officers and loan officers. RPA’s potential for job replacement gets a lot of media attention. But this ignores the fact that in some markets, such as Japan, it is getting increasingly difficult to find people to do jobs in the first place. Japan’s aging population is losing employment-age adults, a fate that will befall other developed nations soon.

Positive transformation

The job replacement stories also ignore RPA’s second major area of business transformation, augmentation. This involves complementing or augmenting what you already do, such as using an automotive AI system to help park your car. It’s less about getting robots to do human jobs than about helping humans to do their jobs much better. And even this isn’t the full picture, Professor Lanzolla says.

"It’s less about getting robots to do human jobs than about helping humans to do their jobs much better. And even this isn’t the full picture"

- Professor Gioanvitto Lanzolla, Cass Business School, City, University of London

Digital technology has a third transformative impact that is not often recognised, perhaps because we can’t really imagine how it will play out yet. This is the enabling of new activities altogether, based on new technology platforms such as peer-to-peer networks, connected cars and smart cities. Although the details of this transition will only become apparent over time, we can already get a sense of what lies ahead by considering the impact of previous industrial revolutions.

People reacted with a certain amount of fear, uncertainty and doubt to the arrival of steam in the 1780s, electricity in the 1870s and IT in the 1970s, voicing concerns over the impact these technologies would have on traditional jobs and lives. But the impact of each wave of industrialisation has been overwhelmingly positive, delivering new levels of wealth and well-being. There is no reason to suspect that the digital revolution now underway will be any different.

Business Model Transformation

Certainly, that’s the expectation among a growing number of business leaders. The research firm Gartner reported in June that the market for RPA software grew 63% in 2018, making it the fastest-growing segment of the global enterprise software market, and is forecast to hit $1.3 billion this year.

RPA Software Revenue Forecast to Reach $1.3 Billion in 2019

- Gartner Report

Particularly among banks and insurance companies, “the ability to integrate legacy systems is the key driver for RPA projects,” says Fabrizio Biscotti, research vice president at Gartner. “By using this technology, organisations can quickly accelerate digital transformation.”

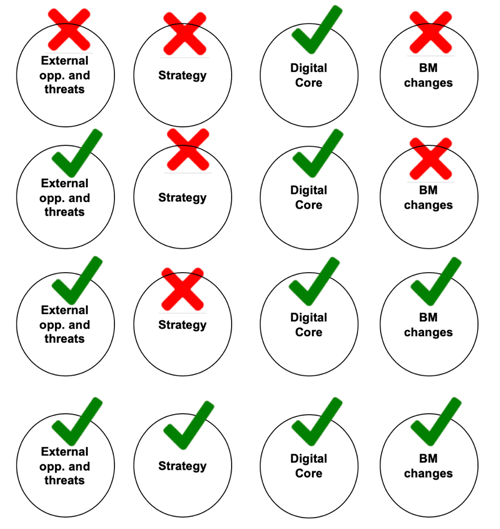

There is a catch, though. Most digital transformation projects simply focus on updating a company’s core IT systems, which is a necessary but not sufficient condition for success. Instead, leaders need to understand that true transformation can only be achieved by changing not just the digital core but also the company strategy, business model and response to external opportunities and threats.

Process mining

To do all this requires a deep understanding of the processes that underpin your business. Hence a growing focus on an emerging field called process mining. The analytics leader Celonis defines this as “an analytical discipline for discovering, monitoring and improving real processes by extracting knowledge from event logs readily available in today’s information systems.”

It works by capturing the digital footprints that people leave behind as they move through a process, to see what actually happens inside a company rather than what is supposed to happen. The results can be surprising. In one case cited by Celonis, a global health services company discovered its finance function was carrying out processes in 500 different ways, costing “an unhappy percentage of revenue.”

Because of situations like these, process mining is becoming recognised as a vital first step in any RPA or digital transformation exercise. Lanzolla says: “If you want to be successful, you need to spend money on the digital core [but] the process of decision making should be [about] understanding the trends, understanding what you want to react to, making choices and changing the business model.”

A massive opportunity

Process mining is becoming available just as business leaders start to grasp the magnitude of the digital transformation opportunity, and the risks of not taking part. Over the last decade, the world’s former top companies by market capitalisation, such as Exxon Mobil and General Electric, have been replaced by digital leaders such as Apple and Alphabet.

Digital technologies will add as much value to the world’s global domestic product as China contributes today. If you want a part of it, start looking into process mining today.

- Professor Gioanvitto Lanzolla, Cass Business School, City, University of London

And there is more to come: citing IBM, Lanzolla says that digital technologies will add as much value to the world’s global domestic product as China contributes today. If you want a part of it, start looking into process mining today!

Learn how to apply process mining to make better automation decisions at the free Infomentum knowledge-sharing roadshow.